- Whales are steadily accumulating LINK, signaling longer-term confidence

- Grayscale continues to hold its LINK position as exchange supply tightens

- The launch of a spot ETF could expand institutional demand if market conditions cooperate

Chainlink is quietly finding its way back onto the radar of both crypto whales and institutional investors. While the broader market still feels unsure of itself, on-chain data suggests confidence around LINK is building, not fading. Accumulation, not speculation, seems to be the theme.

Recent wallet activity points to larger players stepping in with size. These aren’t fast flips either. The behavior looks patient, deliberate, and very familiar to anyone who has watched long-term positioning form before.

Whales Are Adding, Not Chasing

Data from Arkham shows a single whale recently withdrew 171,000 LINK, worth roughly $2.36 million, from Binance. That wasn’t a one-off move. Over the past month, the same wallet has accumulated close to 790,000 LINK at an average price around $12.72. That kind of consistency usually hints at conviction, not impulse.

The message here is fairly clear. This investor appears willing to sit through short-term noise in exchange for potential outperformance down the road. It’s the kind of accumulation that tends to happen before narratives fully catch on, not after.

Leverage Traders Are Leaning In Too

Derivatives markets are telling a slightly different, but related, story. OnChain Lens reported that a newly created wallet deposited $5 million in USDC on Hyperliquid and opened leveraged long positions in both LINK and DOGE. The LINK position was taken at 5x leverage, while DOGE was pushed even harder at 10x.

At the moment, the combined trade is showing a floating loss of around $600,000 on a $28.2 million position. Still, the willingness to deploy leverage during choppy conditions suggests traders are positioning early, not waiting for perfect confirmation. Risky, yes, but it highlights growing appetite around LINK exposure.

Institutions Keep Holding While Supply Tightens

On the institutional side, Grayscale continues to play a steady hand. Its LINK Trust recently hit a new all-time high in total net assets, approaching $90 million, with current holdings around $87.15 million. More notably, data from Coinglass shows Grayscale has held roughly 1.31 million LINK for nearly two years without selling.

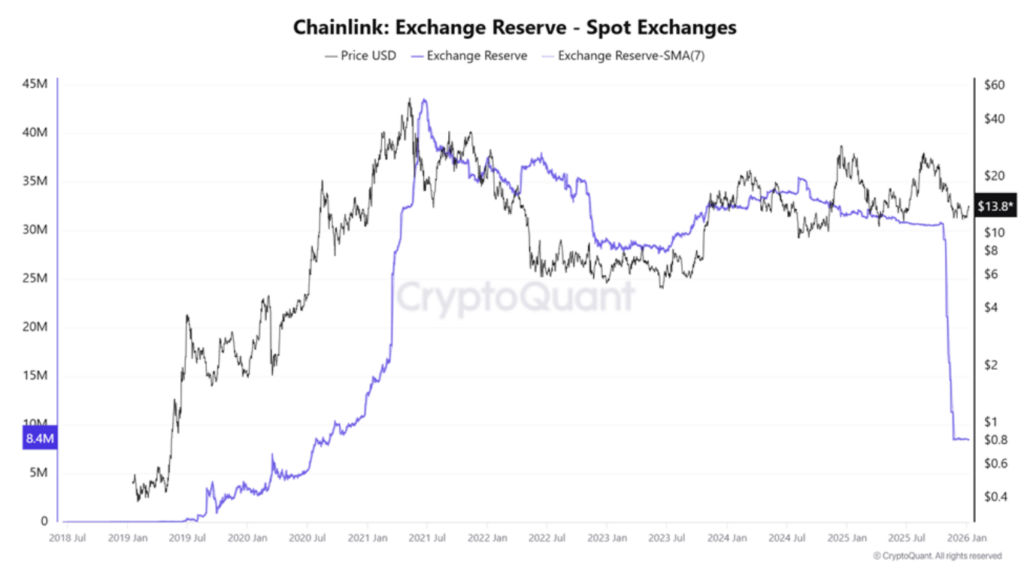

That kind of consistency matters. Combined with ongoing whale accumulation, it’s contributing to a noticeable decline in LINK balances on exchanges. CryptoQuant data confirms exchange reserves are sitting near historical lows, which often signals reduced sell pressure and tighter available supply.

A Spot ETF Adds Another Layer

Adding fuel to the story, Bitwise has secured approval from the SEC to launch a spot Chainlink ETF under the ticker CLNK on NYSE Arca. Trading is expected to begin this week, marking Chainlink’s first direct exposure to US equity markets. The ETF will custody assets through Coinbase Custody and BNY Mellon, offering a familiar structure for traditional investors.

Despite all of this, LINK’s price reaction has been fairly muted so far, up just under 1% to around $13.84 at the time of writing. That disconnect between fundamentals and price often doesn’t last forever, though timing remains unpredictable. Whether this setup translates into sustained upside will still depend on broader market conditions and investor risk appetite.