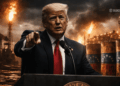

- A positive Coinbase Premium signals real U.S. spot demand, often from institutions.

- Price peaks near the U.S. close can reflect execution strategy, not distribution.

- Quiet accumulation usually precedes larger moves, even if charts look flat.

The Coinbase Premium Gap flipping positive isn’t just a random data point — it’s a clear signal of real spot demand coming from U.S.-based buyers. When Bitcoin trades higher on Coinbase than on offshore venues, it usually means institutions are stepping in, not leveraged traders chasing momentum on Binance. What’s even more telling is the timing. Bitcoin topping out near the U.S. session close doesn’t smell like retail FOMO, it looks more like size being accumulated quietly, without spiking the chart.

Why the Coinbase Premium Actually Matters

A positive Coinbase Premium Gap has a habit of showing up before deeper market moves. Institutions are willing to pay slightly more to get exposure in size, simply because they can’t — or won’t — route meaningful capital through smaller offshore exchanges. That premium isn’t noise. It’s a proxy for U.S. spot demand, and historically, it tends to appear when longer-term positioning is underway rather than short-term speculation.

Why Prices Peak Right at the U.S. Close

To anyone glued to intraday charts, a price peak right at the session close can look suspicious or even bearish. But for institutional desks deploying millions, the goal isn’t nailing the exact high or low. It’s about execution. Orders are sliced, layered, and fed into the market using volume-weighted strategies that minimize slippage. They don’t want their own buying pressure to print the top candle of the day, so accumulation often finishes quietly, right when retail thinks the move is done.

The Long Game Beats the Fast Trade

These aren’t retail traders chasing green candles or flipping positions every hour. Institutions focus on market impact cost — the invisible tax paid when aggressive orders move price against you. That’s why price action can feel oddly flat or capped intraday, even while demand builds underneath. What looks boring on the surface may actually be the foundation for a much larger move later.

What This Really Signals

So yes, the Coinbase premium turning green matters. But pairing it with a local high doesn’t automatically mean distribution. It simply shows that serious capital isn’t playing the candlestick game.

They’re building exposure without owning the next wick. Quiet, steady accumulation rarely looks exciting in real time — and that’s exactly why it tends to be misunderstood.