- A whale withdrew 800 BTC ($71M) from Bitfinex within 24 hours

- Additional withdrawals from Binance point to broader accumulation

- Falling exchange balances may reduce near-term selling pressure

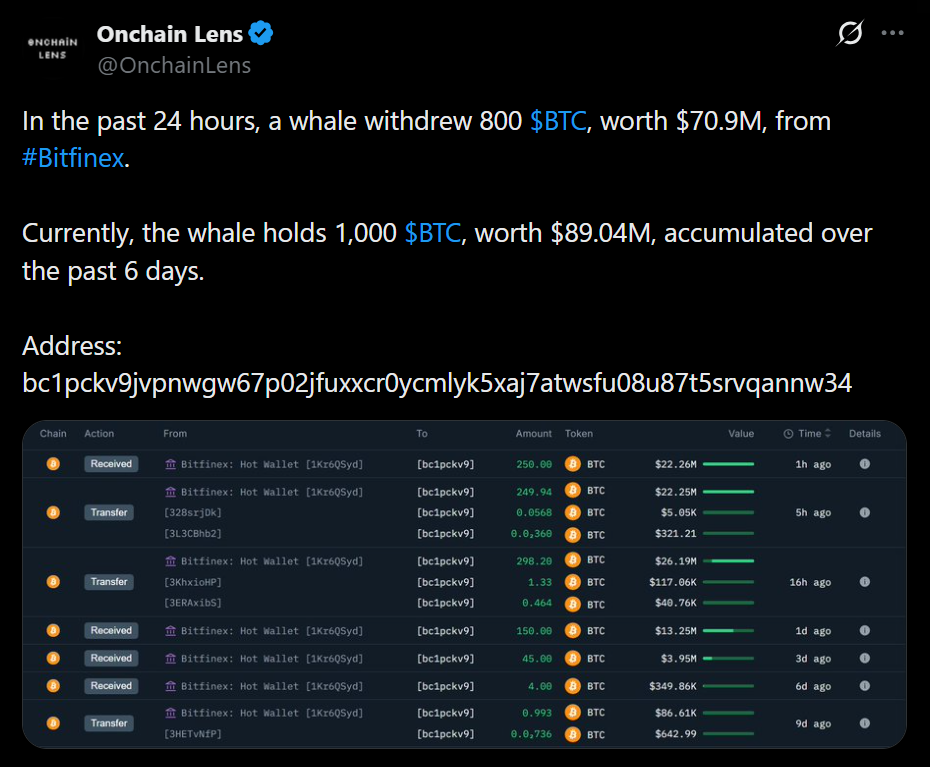

A crypto whale has withdrawn 800 Bitcoin, worth roughly $71 million, from Bitfinex over the past 24 hours, according to on-chain data tracked by OnchainLens. The move follows additional accumulation earlier in the week, bringing the investor’s total purchases to 1,000 BTC, valued at more than $89 million over the last six days.

Large withdrawals of Bitcoin from centralized exchanges into private wallets are often interpreted as accumulation behavior. When major holders move assets off exchanges, it typically signals reduced near-term selling pressure and a longer-term holding mindset.

On-Chain Activity Points to Growing Whale Confidence

This latest withdrawal is not an isolated event. Earlier this week, on-chain data revealed that two newly created wallets pulled a combined 1,600 BTC, worth approximately $144 million, from Binance. The clustering of large withdrawals suggests coordinated accumulation rather than random transfers.

Such activity has historically appeared near market inflection points, when large investors quietly position themselves ahead of broader moves. While not a guarantee of price appreciation, declining exchange balances generally tighten liquid supply.

Bitcoin Price Holds Firm as Accumulation Continues

Bitcoin was trading around $89,500 at press time, up roughly 2% over the past 24 hours, according to CoinGecko. The price strength alongside steady whale withdrawals reinforces the idea that larger players are comfortable accumulating at current levels.

Whether this behavior translates into a sustained rally will depend on broader market conditions, including macroeconomic signals and liquidity trends. Still, consistent accumulation from whales often lays the groundwork for stronger price action once demand accelerates.