- Warren Buffett has stepped down as CEO after 60 years leading Berkshire Hathaway

- The Buffett Indicator has hit a record 221%, signaling potential market overvaluation

- The leadership change arrives amid rising investor anxiety about equity valuations

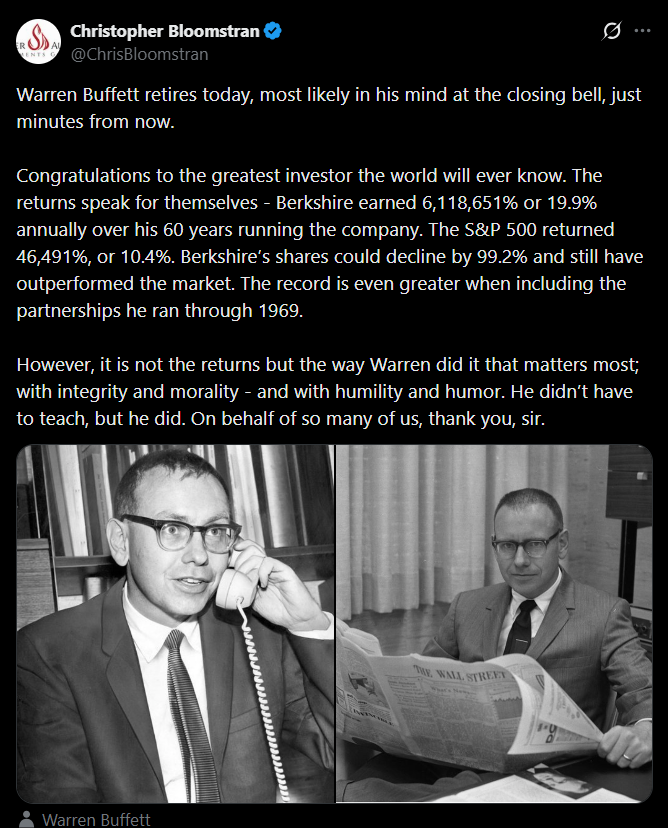

Warren Buffett has officially stepped down as CEO of Berkshire Hathaway, closing a 60-year chapter that reshaped modern investing. The transition comes as Berkshire crosses the $1 trillion mark and longtime lieutenant Greg Abel takes the reins. While the move was planned, the timing has unsettled markets, especially as the so-called Buffett Indicator flashes its strongest warning signal ever.

The End of an Era at Berkshire Hathaway

Buffett, now 96, first announced his decision earlier this year, citing age and the need for generational leadership. What began as a struggling New England textile company evolved under his leadership into one of the most valuable conglomerates in the world. In a recent letter to shareholders, Buffett reiterated his confidence in Abel, praising his judgment, discipline, and ability to lead Berkshire through its next phase.

Though stepping away from the CEO role, Buffett will remain non-executive chairman and plans to stay engaged with the company’s long-term direction.

Why the Buffett Indicator Is Raising Red Flags

The transition coincides with a worrying macro signal. The Buffett Indicator, which compares total U.S. stock market value to GDP, has surged to a record 221%. Historically, elevated readings have preceded major market corrections, suggesting equities may be deeply overvalued relative to the real economy.

While Buffett has cautioned against using the indicator in isolation, its current level has amplified investor anxiety. The combination of stretched valuations and a leadership handoff at one of America’s most iconic investment firms has made some market participants uneasy.

A Symbolic Moment for Markets

Buffett’s career has been defined by patience, discipline, and value investing alongside longtime partner Charlie Munger. With both figures now out of day-to-day leadership, investors are grappling with more than a corporate transition. For many, it marks the fading of an era when valuation fundamentals clearly anchored markets.

Whether this moment becomes a turning point or simply a symbolic milestone will depend on how markets respond in the months ahead. For now, the optics alone are enough to keep traders cautious.