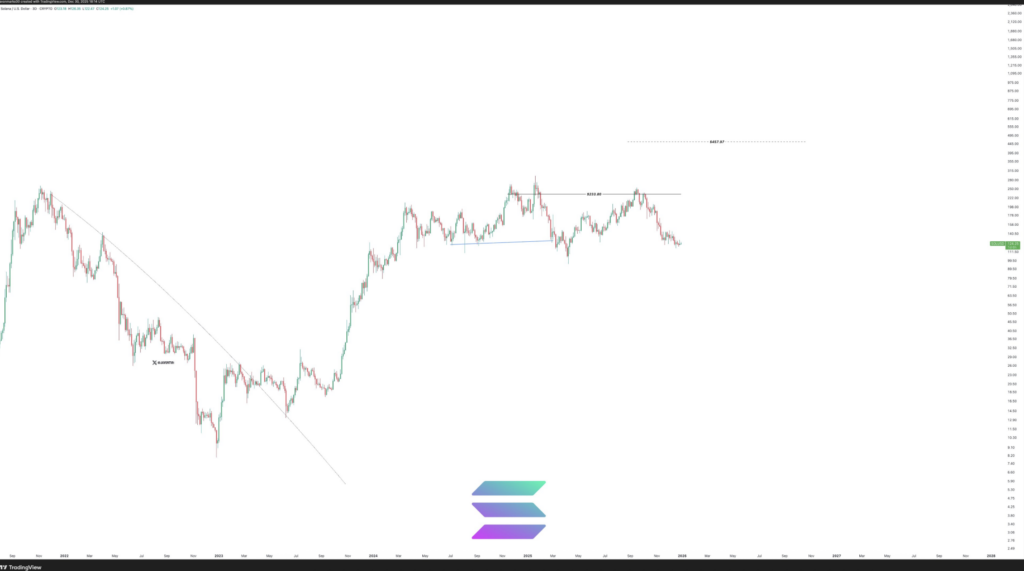

- Solana is consolidating after completing a 1,350% cycle advance, not showing signs of structural breakdown.

- The $233.8 zone remains a key resistance, acting as a profit-taking and digestion area rather than a market top.

- Long-term trend structure stays intact as long as SOL holds above the $120–$123 macro support zone.

Solana’s price action has shifted gears. After completing one of its strongest cycle advances to date, the asset is no longer racing higher, but it also isn’t breaking down. Instead, SOL has settled into a controlled consolidation phase, with traders now focused on clearly defined resistance overhead and long-term support below.

The broader structure still matters here. Solana previously climbed from its cycle low near $16.12 all the way to the $233.8 region, a move that delivered roughly a 1,350% expansion. That level wasn’t random either. Analysts had marked it well in advance as a projected resistance zone, not a final peak.

Javon Marks noted on X that SOL tagged this target with striking accuracy. When price hits a level like that after such a long run, hesitation is normal. Profit-taking, hedging, and positioning adjustments usually follow, and Solana is no exception.

Resistance Near $233.8 Triggers Orderly Distribution

Since reaching the $233.8 zone, Solana hasn’t collapsed. That’s an important detail. Instead of a sharp reversal, price action has cooled into sideways movement, suggesting digestion rather than exhaustion.

Each push into that resistance has drawn selling pressure, reinforcing the level’s importance. Still, the reactions have been controlled. Analysts describe this behavior as distribution within strength, not a breakdown of trend. In high-liquidity assets, major cycle advances often pause at projected levels before attempting further progress.

On lower timeframes, this shows up as compressed ranges and overlapping candles. Momentum has slowed, but volatility hasn’t exploded. Buyers continue to step in on dips, while sellers keep rallies capped, creating a tight equilibrium that feels more like stored energy than surrender.

The $120 Zone Anchors Solana’s Larger Cycle Structure

Zooming out, Solana’s macro structure remains intact. Price continues to respect a rising trendline that traces back to the 2023 lows. That trendline intersects with the $120–$123 region, turning it into a critical support zone.

This area isn’t just technical decoration. Multiple historical reactions have confirmed it as a demand zone, and it also lines up with prior horizontal support. Add in its position near the midpoint of the broader cycle range, and the level gains even more weight.

As long as SOL holds above $120, the higher-low structure survives. That keeps the bullish cycle framework alive, even if price continues to consolidate. A decisive break below that region would change the narrative. Until then, the market appears to be testing demand, not abandoning the trend.

In short, Solana isn’t showing signs of panic or failure. It’s pausing, measuring itself, and waiting for the next decision. Whether that resolves higher or lower will depend on how price behaves around these clearly defined levels.